22.01.31

PayPay Corporation

PayPay Card Corporation

Z Holdings Corporation

Yahoo Japan Corporation

Launch of PayPay Atobarai, a Convenient and Self-Contained Payment Method in the "PayPay" App

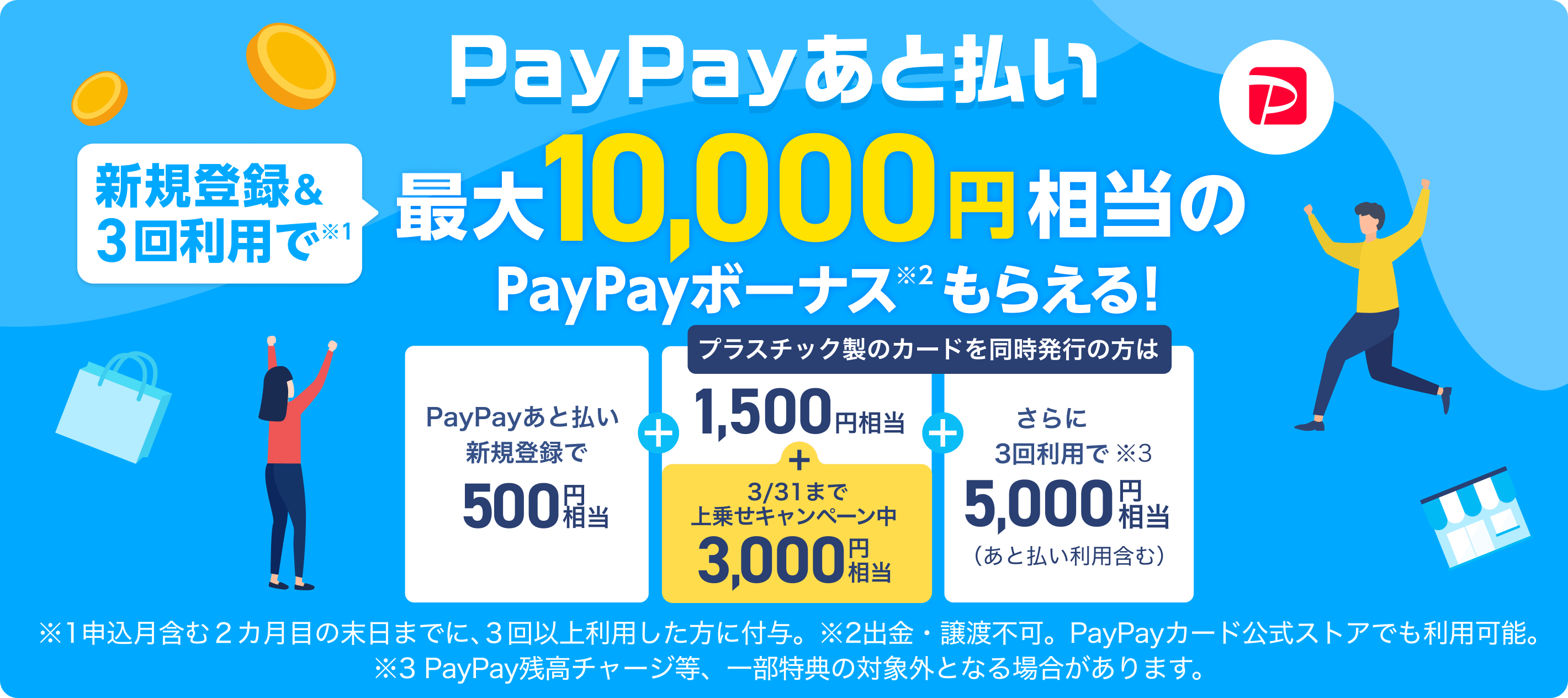

- Signup benefits of PayPay Bonus worth up to 10,000 yen to users applying for the plastic card and making more than three payments

- A campaign that gives 2.5% more bonus than other payment methods also to be held

Signup page: https://card.yahoo.co.jp/paypaycard/campaign/app

Outline of PayPay Atobarai Campaign:https://paypay.ne.jp/event/atobarai/

PayPay Corporation (Headquarters: Minato-ku, Tokyo; President & Representative Director, CEO, Corporate Officer: Ichiro Nakayama; hereinafter "PayPay"), and PayPay Card Corporation (Headquarters: Chiyoda-ku, Tokyo; President and Representative Director: Tomoaki Tanida) will begin providing PayPay Atobarai (deferred payment) from February 1, 2022. PayPay Atobarai enables users to pay the amount used in the current month in a lump sum the following month through the "PayPay" app. Users will be able to use a virtual PayPay Card once they have completed their registration from the "PayPay Pay Later" mini app.

Related website; https://www.paypay-card.co.jp/company/info/000278.html (Japanese only)

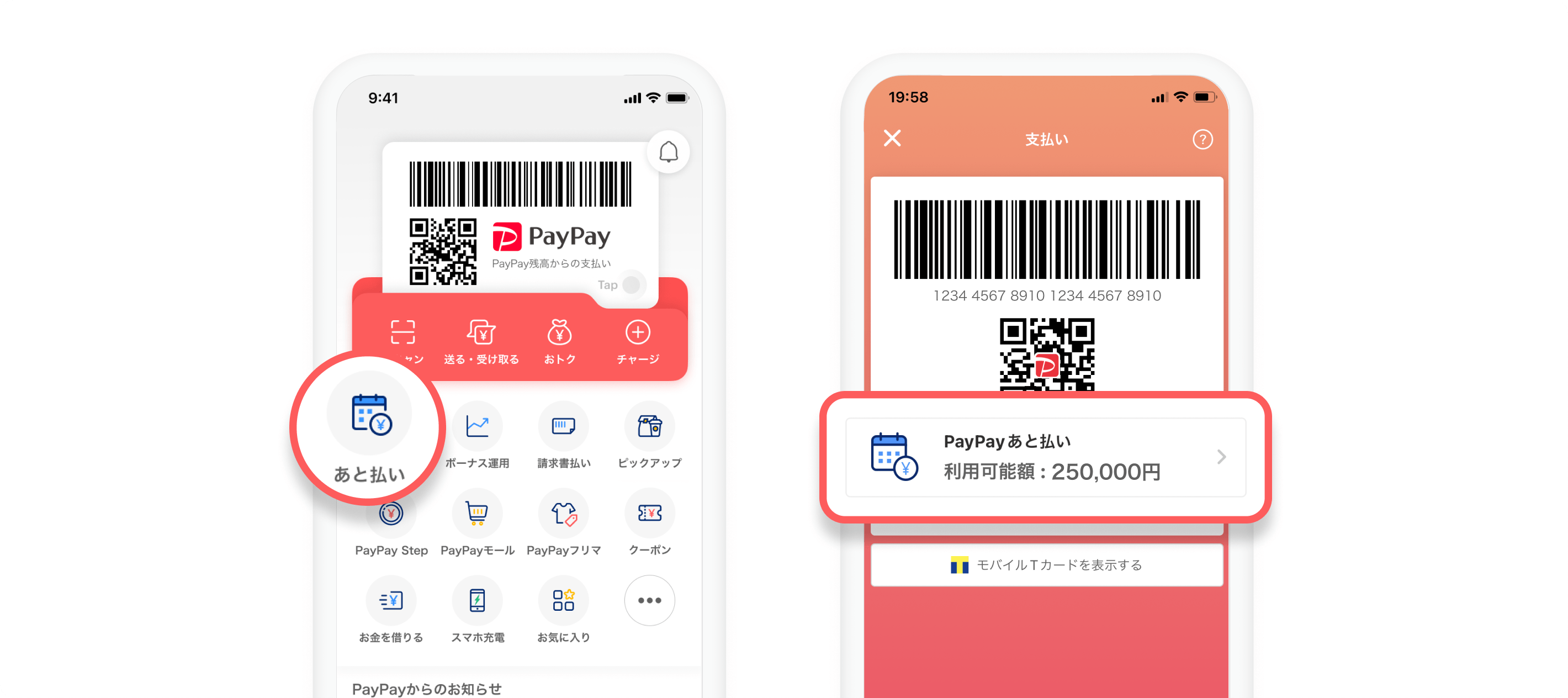

Image of "PayPay Pay Later"

The image is for illustrative purposes only

Furthermore, if users have a plastic PayPay Card issued when they register for PayPay Atobarai and use either the PayPay Card or PayPay Atobarai more than three times*1, users can earn a maximum of 7,000 yen worth PayPay Bonus as signup benefits (maximum 10,000 yen from Tuesday, February 1 to Thursday, March 31, 2022). For details and conditions, please visit thesignup benefits page.

*1 Signup benefits will be granted to users who have used the services at least three times by the end of the second month including the month of application. Some benefits may not be applicable (e.g. PayPay Balance top up).

The image is for illustrative purposes only

■ Features of PayPay Atobarai

PayPay Atobarai is PayPay's deferred payment method that allows users to pay the amount used in the current month in one payment the following month. It can be used as PayPay's payment method without topping up the PayPay Balance. To be eligible, users must be 18 years of age or older (excluding high school students), must agree to the Terms of Use, and complete the prescribed application, including identity verification and screening procedures. If identity verification is already completed with PayPay, users will not have to go through the trouble of entering their personal information to apply for PayPay Atobarai. The current PayPay Atobarai (lump sum only)*2 is only available for lump-sum payments in the following month, but the new PayPay Atobarai allows users to switch to revolving credit after payments are made.

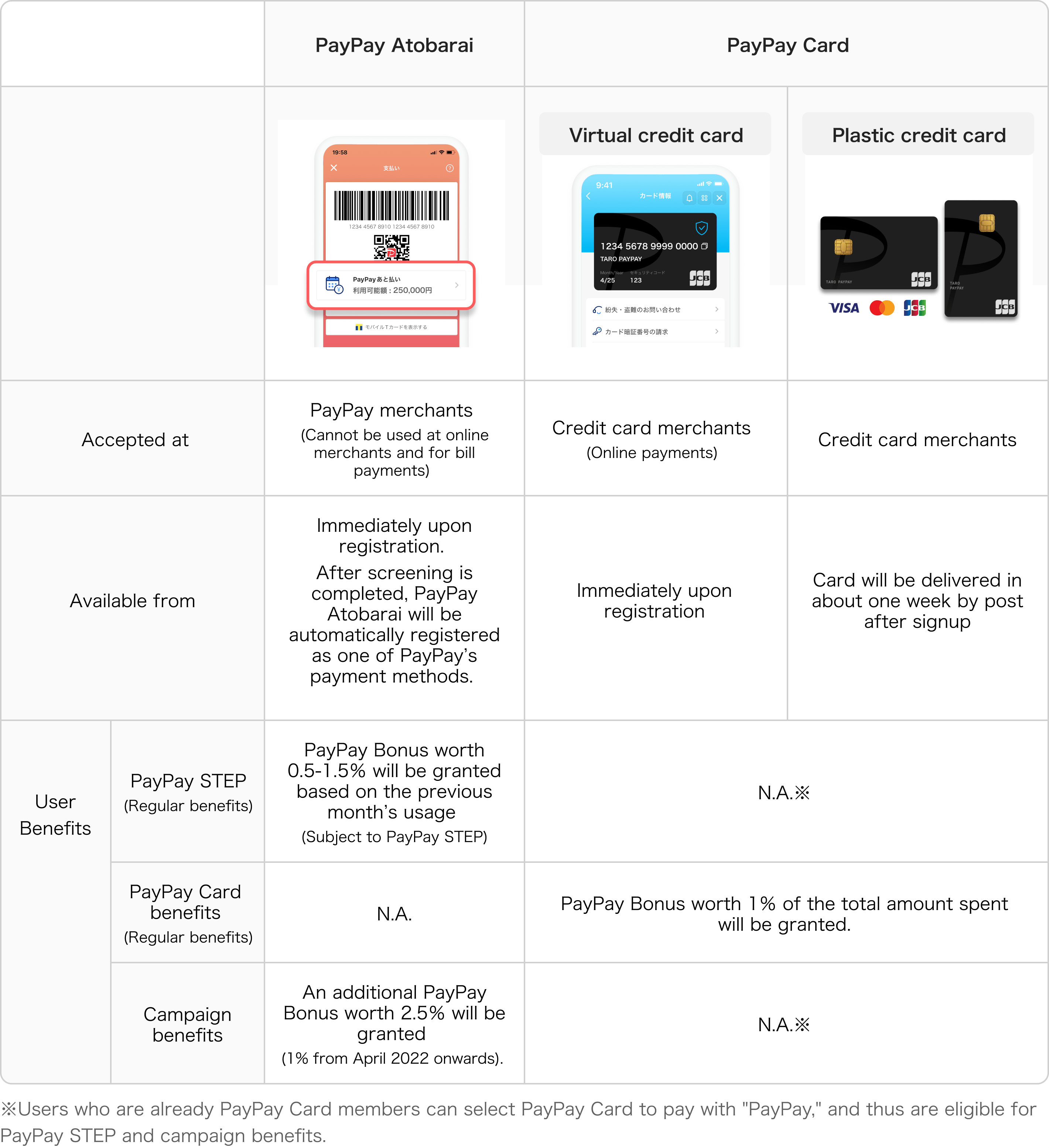

Payments made using PayPay Atobarai count towards PayPay STEP, a rewards program which grants a PayPay Bonus of up to 1.5% depending on the previous month's usage, and are also eligible for its benefits.

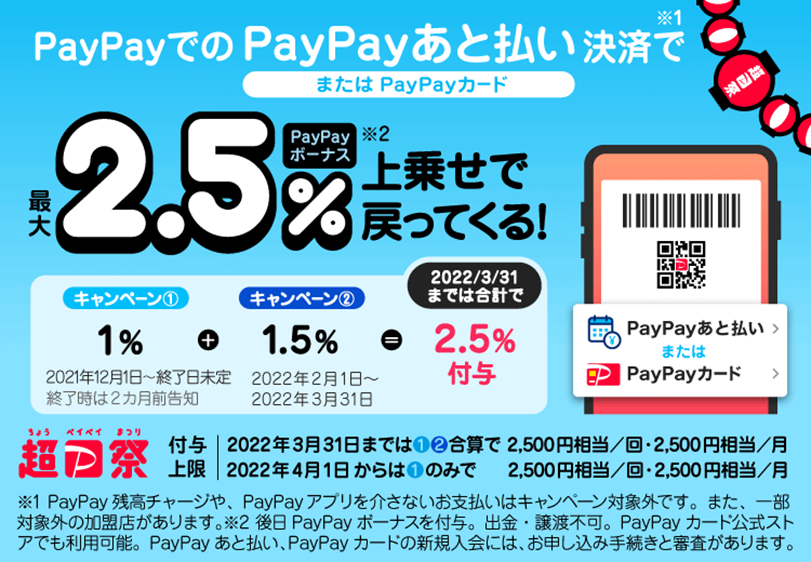

Furthermore, PayPay Atobarai payments will be eligible for the "Pay with PayPay Atobarai to Get 1% Bonus Campaign,*3" and from Tuesday, February 1 to Thursday, March 31, 2022, for the "Pay with PayPay Atobarai to Get 1.5% Bonus Campaign," which is part of the previously announced Cho PayPay Matsuri (Super PayPay Festival). This means that payments with PayPay Atobarai will earn 2.5% more PayPay Bonus compared to other payment methods. For details and conditions, please refer to the"PayPay Atobarai Campaign" page.

PayPay Atobarai can be used in physical PayPay merchant stores and is also scheduled to be available in Yahoo! JAPAN's services, such as Yahoo! JAPAN Shopping and PayPay Mall, and other online merchants.

*2 Provided to randomly selected users based on factors such as attribute information and usage status.

*3 Date of termination undecided. Two months' notice will be given before the campaign ends.

<Notes on applying for PayPay Atobarai>

・Current Yahoo! JAPAN Card members

Yahoo! JAPAN Card members can apply to register through a dedicated form on the "PayPay Pay Later" mini app displayed in the "PayPay" app. These members are not eligible for the signup benefits but will be eligible to take part in the "PayPay Atobarai Campaign."

・Current PayPay Card members

PayPay Card members will be able to register for PayPay Atobarai as soon as the service is ready for registration.

■ Two Types of PayPay Cards Available―Virtual and Plastic

There are two types of PayPay Cards*4―a plastic credit card, and a virtual credit card that can be used in e-commerce websites without holding a physical card. When users apply for PayPay Atobarai in the "PayPay" app, they will be able to use the virtual version of the PayPay Card as soon as the screening process is completed. Users can also opt to have a plastic PayPay Card issued.

Credit card numbers and security codes can be checked on the "PayPay Pay Later" mini app.*5. By entering the credit card number, the virtual card can be used as a credit card payment method on e-commerce websites, and others.

*4 "PayPay Card, Credit Card That Earns PayPay Bonus, Will Open to Membership Applications" (November 30, 2021)

https://www.z-holdings.co.jp/en/pr/press-release/2021/1130

*5 Applicable only when users subscribe from the "PayPay Pay Later" mini app on the "PayPay" app. Users who already have a PayPay Card or those who applied by means other than the "PayPay" app will be able to check their credit card numbers and security codes from the membership menu on the PayPay Card website.

PayPay Card (virtual card)

The image is for illustrative purposes only

The plastic PayPay Cards are available in three brands: JCB, Visa, and Mastercard*6, which are accepted as normal credit cards also by credit card merchants that are not PayPay merchants. Plastic cards have no credit card numbers or security codes printed on them, thus are free from concerns of having the numbers seen by others. Furthermore, they are also compatible with contactless payments provided by JCB, Visa, and Mastercard, which allows users to pay by simply holding the card over a special terminal without the need for a signature or a PIN. The credit card number and security code will be the same as the virtual card and can be checked on the "PayPay Pay Later" mini app.

*6 The brand of the virtual card will be JCB unless users apply for a plastic PayPay Card when applying for PayPay Atobarai.

PayPay Card (plastic card)

The image is for illustrative purposes only

<Features of PayPay Atobarai and PayPay Card*7>

*7 "PayPay Atobarai" can be used to top up the PayPay Balance (topped up as PayPay Money Lite). Auto top up is not available.

■ About PayPay Card Corporation

After changing its name from YJ Card Corporation, PayPay Card Corporation started operations from October 1, 2021, aiming to become the number one credit card company in Japan.

By strengthening collaborations with companies of the Z Holdings Group, including PayPay and its cashless payment service, PayPay Card Corporation will expand its services to accommodate diverse payment needs and increase convenience for users.

■ About "PayPay," the cashless payment service provided by PayPay Corporation

PayPay is a cashless payment service expanding across the country, available not only at major chain stores but also at small and medium size retailers, vending machines, taxis and even public transportation. It can also be used in a variety of other scenes, including paying for online services and utility bills. PayPay is also expanding its range of services beyond just payments, including a "send/receive" feature (remittance/transfer and receiving of money) that allows users to transfer their PayPay balance (PayPay Money and PayPay Money Lite) between each other for free, or "bonus management", a service that allows users access to a simulated investment experience involving the exchange of PayPay Bonus with points provided by a Type 1 Financial Instruments Business Operator that PayPay partners with. The company also strives to create a safe and convenient environment for users through a hotline available 24/7 and a full compensation scheme ensuring, compensation for any damages that may be suffered.

PayPay is registered as follows:

・Prepaid Payment Instruments (third party type) Issuer, Registration #: Director-General of the Kanto Finance Bureau, No. 00710 (Registration date: October 5, 2018)

・Fund Transfer Operator, Registration #: Director-General of the Kanto Finance Bureau, No. 00068 (Registration date: September 25, 2019)

・Japan Payment Service Association (https://www.s-kessai.jp/, Date of admission: September 12, 2018)

・Bank Agency Operator, License: Director-General of the Kanto Finance Bureau, No. 396 (Registration date: November 26, 2020)

・Business Operator that Concludes Contracts on the Handling of Credit Card Numbers, etc., Registration #: Kanto (K) No. 106 (Registration date: July 1, 2019)

・Japan Consumer Credit Association (https://www.j-credit.or.jp/, Date of admission: July 1, 2019)

・Financial instruments intermediary service registration number: Kanto Finance Bureau Director (Kinchu) No. 942 (Registration date: June 25, 2021)

* "PayPay" provides 4 types of PayPay balance: PayPay Money, PayPay Money Lite, PayPay Bonus and PayPay Bonus Lite. PayPay Money can be used to pay for partner services and merchants if it is within the amount deposited into the PayPay account opened after completing an identity verification process. It can also be used for sending and receiving money between PayPay users free of charge. PayPay Money can also be cashed out to a designated bank account (no withdrawal fee if using PayPay Bank). The legal nature of this is an electromagnetic record which can be used to pay for goods and other services, and can be remitted or cashed out, issued by the Company who is a Fund Transfer Operator registered under Article 37 of the Payment Services Act. Based on the provisions of Article 43 of the Payment Services Act, PayPay preserves the debt it owes to its users in full amount and more by depositing its assets. PayPay Money Lite is an electronic money issued by PayPay, which can be purchased and used to pay for services and merchants. PayPay users can transfer and receive PayPay Money Lite free of charge. The legal nature of this is a prepaid payment instrument issued by PayPay (Article 3, Paragraph 1 of the Payment Services Act). Based on the provisions of Article 14 of the Payment Services Act, PayPay preserves the relevant assets for the purpose of protecting the owners of the prepaid payment instrument by providing a security deposit for issuance to the Legal Affairs Bureau in an amount that is half or more of the unused balance of prepaid instrument methods as of March 31 and September 30. In addition, PayPay Bonus and PayPay Bonus Lite, which are granted through campaigns and promotions when using PayPay, can be used for partner services and merchants in addition to PayPay Money and PayPay Money Lite. However, PayPay Bonus and PayPay Bonus Lite cannot be sent or transferred between PayPay users or be cashed out. PayPay Bonus Lite has an expiration date, after which date it will no longer be valid.

PayPay also strives to create a safe and secure environment for users. If an unexpected payment is made by a third person using a PayPay account, or if a request to settle a payment suddenly arrives from PayPay to a user that does not have a PayPay account, there is a scheme that ensures compensation for the damages suffered (the difference will be provided as compensation in the event that compensation if also provided by another third party), given the prescribed conditions are met. Please see applying for compensation for details.

Unless otherwise specified, English-language documents are prepared solely for the convenience of non-Japanese speakers. If there is any inconsistency between the English-language documents and the Japanese-language documents, the Japanese-language documents will prevail.